Gift of Personal Residence or Farm with Retained Life Estate

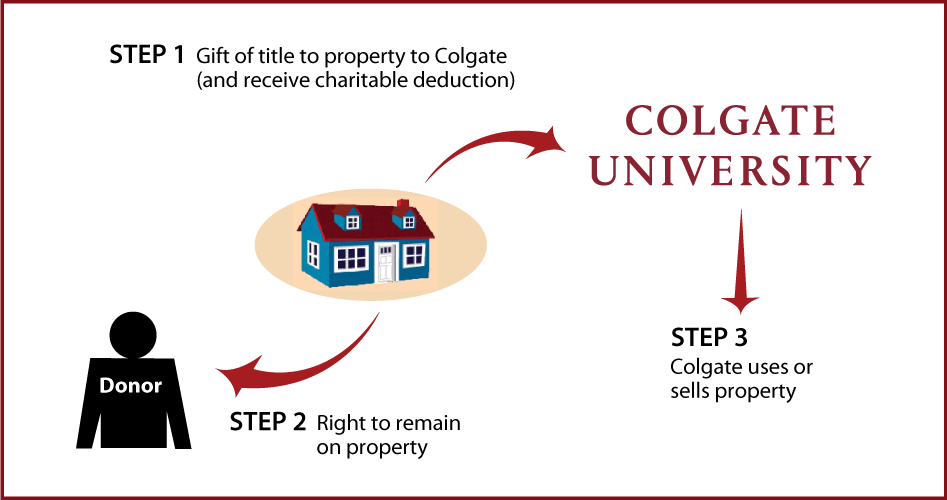

How It Works

- Transfer title to personal residence or farm to Colgate

- No change in your lifestyle—you (and spouse) occupy and enjoy residence or farm for life

- Colgate keeps or sells property after your death(s)

Benefits

- No out-of-pocket cost for substantial gift to Colgate

- Federal income-tax deduction for remainder value of your residence or farm

- You (and spouse) can occupy residence for life

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Andrew M. Coddington Kim Manner |

Teresa Mathews |

The discussion herein is general in nature and may not apply to all individuals. Prospective donors are urged to consult their personal tax and financial advisors concerning the specific consequences of making gifts to Colgate. We would be pleased to discuss, in confidence, ways in which you may support Colgate. These measures may also have an impact on your estate planning.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer