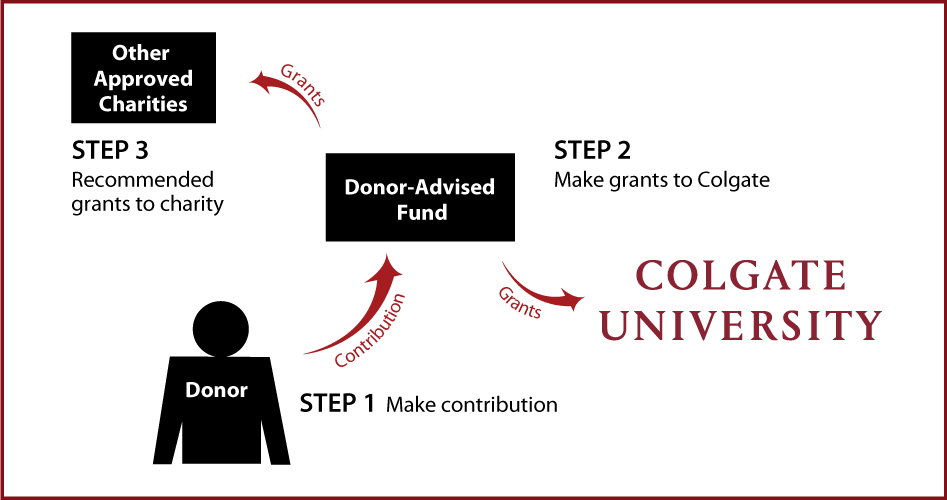

How It Works

- You make a contribution to a donor-advised fund at Colgate

- You advise Colgate where you want to make grants

- You may make recommendations for additional grants to approved charities

Benefits

- You create a fund to support Colgate and other charities

- You receive an income-tax deduction for your original contribution to the fund

- Your fund will receive professional asset management

- You have the flexibility of making grants to charities on a flexible timetable

Contact Us

Andrew M. Coddington

Associate Vice President, Office of Advancement

Director of Planned Giving

(315) 228-7450

acoddington@colgate.edu

Kim Manner

Department Administrator

(315) 228-7450

kmanner@colgate.edu

Teresa Mathews

Associate Director of Planned Giving

(315) 228-6936

tmathews@colgate.edu

The discussion herein is general in nature and may not apply to all individuals. Prospective donors are urged to consult their personal tax and financial advisors concerning the specific consequences of making gifts to Colgate. We would be pleased to discuss, in confidence, ways in which you may support Colgate. These measures may also have an impact on your estate planning.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer