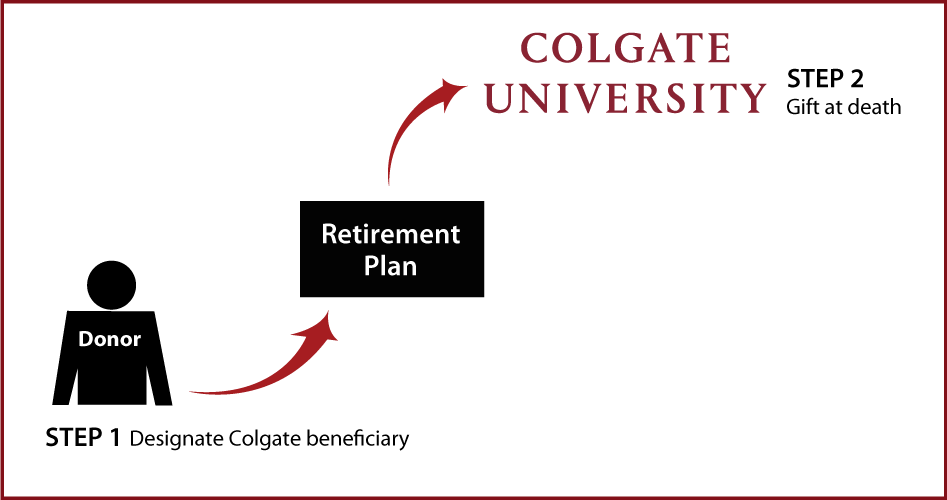

Gifts from Retirement Plans at Death

How It Works

- You name Colgate as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to Colgate

- No federal estate tax on the funds

- You make a significant gift for the programs you support at Colgate

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Andrew M. Coddington Kim Manner |

Teresa Mathews |

The discussion herein is general in nature and may not apply to all individuals. Prospective donors are urged to consult their personal tax and financial advisors concerning the specific consequences of making gifts to Colgate. We would be pleased to discuss, in confidence, ways in which you may support Colgate. These measures may also have an impact on your estate planning.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer