Donor Stories

Featured Stories

Leslie Kaufman ’74

Sculpting the Future: Leslie Kaufman ’74

Harry H. Lang Jr. ’48

A True Trailblazer: Harry H. Lang Jr. ’48

Jim 73, MAT ’76 and Sarah Laditka ’74

Opening Doors for the Next Generation: Jim Laditka ’73, MAT ’76 and Sarah (Rubinton) ’74 Laditka

Ray ’69 and Leslie Heaslip Wengenroth ’74

A Meaningful Gift with a Steady Return: Ray ’69 and Leslie Heaslip Wengenroth ’74

Paul ’77 and Susan Blazar Friedman ’78

A Simple Way to Pay It Forward: Paul ’77 and Susan Blazar Friedman ’78

William McClean III ’63

A Foundation for Life: William McClean III ’63

Roger Herr ’70

Roger Herr ’70 and a Winning Idea

Liz Buchbinder ’77

Truly Transformative: A Conversation with Liz Buchbinder ’77

Kevin Padian ’72, MAT’73

Deferred Gifts: Larger, Later — A Conversation with Kevin Padian ’72, MAT’73

Deb ’74 and Paul ’74 Parker-Johnson

Opening Doors to Growth

Ted Carron ’62

Honoring Ted Carron ’62 Through a Generous Bequest, Ted Will Continue to Advance Research at Colgate

Anna Marie Ward ’81

In Her Own Words

Jane Najarian Porter ’74

Donor Spotlight: Jane Najarian Porter ’74

Lauri Curtis Hadobas ’77

Keeping It Going

James M. Eppolito ’66

Choosing to Pay It Forward: The James M. Eppolito ’66 Endowed Scholarship

Rich Conti ’76

Life Lessons

Jack ’71 and Laurie Hamilton

Laddered, Deferred Annuities to Support the London Study Group

Elizabeth Hartman ’80, P’10

The Art of Giving

John and Allison Langan ’84

Plan Future Gift to Colgate

MacDonell “Don” Roehm Jr. ’61

Gives IRA to Help Colgate Soccer and Colgate Athletics

Walter Broughton ’63

A Man of Many (Planned) Gifts

Janet and Bill Maley P’09

Why We Chose a Flexible Deferred Charitable Gift Annuity with Colgate

More Stories

Margaret A. “Peg” Flanagan ’80

Alumnae Leadership Council Founder Peg Flanagan’s Gift Is Smart Financial Planning

Thomas Pursley ’66

Celebrates Liberal Arts Education Through a Bequest from His Retirement Plan

Len Dennick and Jack Goodreds

Friends Think Ahead for Their Class of ’56 Scholarship

Alden (Joe) Doolittle ’67 and his wife Gay

Leave a Legacy for Future Generations

Jim C ’68 and Sheri Quick

Insurance Gift Provides for Future Students

Ellis ’57 and Suzee Rowland

Choosing Colgate

Thomas A. Pursley III ’66

Funds Second Gift Annuity with Colgate Because “Education Is a Beautiful Thing”

Denis Cronin ’69

Reflects On His Colgate Involvement and Why He Joined the Willow Society

Paul Jenkel ’60, John McQueen ’70, and Barrett Petty ‘63

Planned Gifts Make an Impact

Robert R. Ammarell ’65, Robert E. Aberlin ’66, and Thomas H. Weidemeyer ’69

Gifts to Colgate Can Benefit Retirement and Create a Philanthropic Legacy

Charles H. Harff ’51 and David McIntyre ’10

Harff Gift Annuity Scores a Great Scholarship for Hockey Star

Robert Fox ’59

Gives Back to Colgate Through IRA Rollover

Hans ’42 and Nancy Guenther

Nancy Guenther Continues Late Husband's Support of Colgate with Gifts of Her Own

Nancy and Dr. Richard Gates ’50

Students and Nancy Gates Benefit from Charitable Gift Annuity

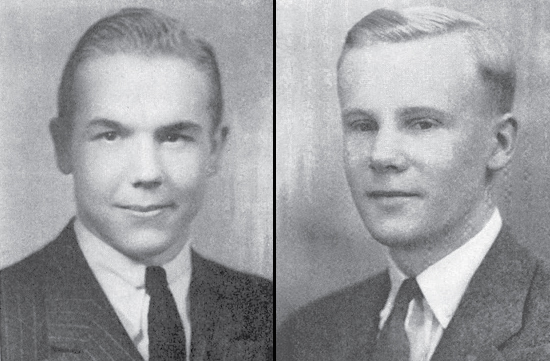

Dr. Howard "Hoddy" Jones ’39 P’67 and Cecil Semple ’39

Two Great Colgate Men Helping Others Have the Same Opportunities

Bruce Warwick ’60

Gift celebrates how Colgate inspired real estate developer Bruce Warwick ’60.

Kenneth Hillyer ’49

Under the stewardship of Colgate and Kaspick & Company, what was once a dilemma for Kenneth Hillyer ’49 has turned into a blessing.

Ed Safford ’58

Makes a difference by giving to Colgate

Ron ’56 and June Schaupp

"I acquired the ability to reason and think and to express myself verbally and with the written word. I came away from Colgate with an insatiable urge to learn. I feel I owe Colgate for what it provided me," says Schaupp, who has created a generous bequest provision.

Robin Jaycox ’53

"I had some securities that had significant appreciation and the gift annuity allowed me to lock in my gain, avoid capital-gain tax, and receive a very competitive interest income," says Jaycox.

George ’40 and Dorothy Fisk

"I recognized that gifting the IRA to my children would not be tax-wise since estate and income taxes would take as much as 85 percent of the corpus. So it made sense to provide for my children and grandchildren with other assets and to use the IRA to make a gift to Colgate after my wife and I pass on."

Dick ’56 and Betty Hanaway

Like the rest of his life, Dick's giving to Colgate has been both creative and unique. "There are no significant tax benefits to giving Colgate a promissory note but my main interest was to make a planned gift to Colgate using the equity in real estate while providing income for both of us during our lives."

Fred Meendsen ’54

"I had some stock that kept appreciating, so I was faced with a significant capital-gain tax if I sold it. I decided to give my stock to Colgate's pooled income fund. It provides my wife and me with a steady income and because the fund is well managed, it's been a good hedge against inflation. After my wife and I pass on, Colgate will receive the corpus."

Tom ’57 and Roberta Van Note

"I do appreciate what Colgate did for me and giving back is worthwhile. You can't do anything better than help educate young people," states Tom. The Van Notes used real estate to make a gift to Colgate that would have been impossible otherwise. "I wouldn't have taken the sum like that out of my investments."

The discussion herein is general in nature and may not apply to all individuals. Prospective donors are urged to consult their personal tax and financial advisors concerning the specific consequences of making gifts to Colgate. We would be pleased to discuss, in confidence, ways in which you may support Colgate. These measures may also have an impact on your estate planning.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer