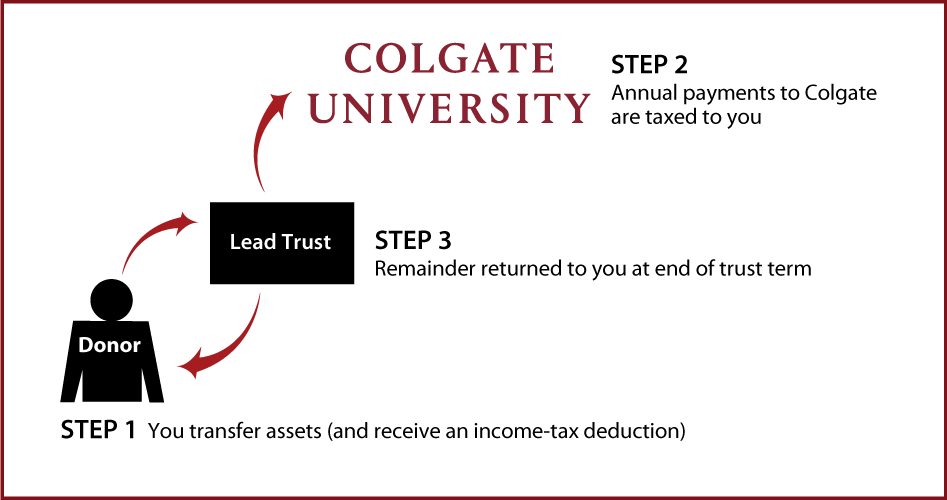

Grantor Lead Trust

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years), transfer cash or other property to trustee, and receive an income-tax deduction

- Trustee invests and manages trust assets and makes annual payments to Colgate

- Remainder transferred back to you

Benefits

- Annual gift to Colgate

- Property returned to donor at end of trust term

- Professional management of assets during term of trust

- Charitable income-tax deduction, but you are taxed on trust's annual income

More Information

Request an eBrochure

Request Calculation

Contact Us

|

Andrew M. Coddington Kim Manner |

Teresa Mathews |

The discussion herein is general in nature and may not apply to all individuals. Prospective donors are urged to consult their personal tax and financial advisors concerning the specific consequences of making gifts to Colgate. We would be pleased to discuss, in confidence, ways in which you may support Colgate. These measures may also have an impact on your estate planning.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer